Park Hills Life

I grew up in Fort Wright and attended Notre Dame Academy. I have been living in Park Hills for 20 years. I have three wonderful sons and five, soon to be six grandchildren. I love living and serving in Park Hills.

I grew up in Fort Wright and attended Notre Dame Academy. I have been living in Park Hills for 20 years. I have three wonderful sons and five, soon to be six grandchildren. I love living and serving in Park Hills.

As a council member for the past 8 years, I am asking for YOUR VOTE for MAYOR, to keep the city fiscally responsible and to move the city forward, with only one agenda – the interest of the tax payers; to use the taxpayer’s money for the taxpayer’s benefit. I will use the same successful principles I have used on Council to better serve as Mayor.

MY GOALS: TO PRESERVE, UNIFY and PROSPER PARK HILLS

Preserve

- Our identity – a welcoming and independent city

- Our own Police and Fire Departments

- Our trees and historic character

- Our strong community spirit in Park Hills

Unify

- Work with Civic and Senior Associations, Tree Board and parks, to strengthen our ties as neighbors and maintain our sense of community

- Promote quality car and pedestrian transportation by maintaining our sidewalks and roads

Prosper

- Support businesses and residents by not over-burdening them with more rules and regulations

- Keep city expenses and taxes down so that our residents and businesses can invest more in their homes and property

- Create a healthy, relational atmosphere for existing businesses and attract new businesses that fit the character of Park Hills by exploring ways of creating a tax incentive zone

- Work with any and all to promote an inclusive environment

Our Current State

This year our property values have increased, giving us a raise in revenues without raising taxes. The job of elected officials is to keep the city safe, take care of roads and services, and manage the budget properly - not to bring in personal agendas.

Park Hills has come a long way since 2010 - from a significant deficit to a healthy reserve.

Park Hills currently enjoys $639,510 in the General Reserve Fund. The auditor has advised the City that it is prudent to maintain a three-month reserve (three months of operating expense for the city – it costs $125,000 per month to run the city). We currently maintain a four-and-a-half-month reserve. We are working toward accumulating a one-year reserve. Additionally, we have worked hard to establish solid protocols to protect each financial transaction. Our most recent audit was quite favorable and is available for your review on our web site at parkhillsky.net.

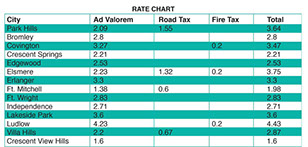

Taxes are complicated matters. Our Park Hills tax rate is 2.09/1,000 for ad valorem and 1.55/1,000 for Road Tax. The combined rate is 3.64/1,000. The basis of valuation is determined by the Kenton County Property Value Administrator. They periodically revalue the homes in the county as well as adjust the values upon sale. For example, a Park Hills home with a valuation of $250,000 would pay $910.00 in city real property tax. Our city collects in ad valorem taxes approximately $485,000* and approximately $300,500* in Road Tax. The Road Tax is a restricted tax and by law may only be spent on our roads.

How does this compare to other cities in our area? This is a frequent question for residents and homebuyers. The following is a chart summarizing the neighboring tax rates. Included are ad valorem, road tax and fire tax charges. There are many other taxes that a city may assess such as school taxes, personal property taxes, municipal insurance taxes, and payroll taxes. This chart does not address those taxes. Cities set their tax rates annually and this chart is based on the current fiscal year. All percentages are based on amount per thousand.

This site is copyrighted 2018 by Visual Digital Solutions, LLC